Financial Obligation Buying Real Estate: Opportunities in New York City

Realty investment supplies a selection of opportunities for generating returns, and one often-overlooked approach is financial debt investing. In New York, with its vibrant and diverse real estate market, financial obligation investing has become an progressively attractive alternative for investors looking for stable earnings and lower danger compared to equity investments. This overview will certainly explore the fundamentals of financial debt investing in property and why New york city provides a distinct landscape for this financial investment approach.

What is Debt Investing in Real Estate?

Financial obligation investing includes loaning resources to property developers or property owners in exchange for regular interest settlements. Financiers essentially serve as the lender, funding jobs with loans secured by real estate as security. If the consumer defaults, the capitalist can recuperate their investment by claiming the property.

Key Attributes of Debt Spending

Foreseeable Returns: Normal passion repayments supply a steady revenue stream.

Reduced Risk: Investments are secured by the underlying property.

Much Shorter Time Frames: Lots of financial obligation financial investments have much shorter durations compared to equity investments.

Why Think About Debt Purchasing New York City Realty?

New york city's property market provides a riches of chances for financial debt investors because of its dimension, diversity, and strength. Below are some factors to focus on the Realm State:

1. High Property Need

From New york city City's high-end condos to upstate multifamily homes, demand genuine estate continues to be strong. This guarantees constant chances for financial debt funding as designers and homeowner look for financing.

2. Diverse Market Segments

New york city's property market extends household, commercial, and mixed-use developments, permitting capitalists to expand their portfolios within the state.

3. Protect Collateral

Quality in New york city typically hold high value, providing durable security for financial debt financial investments. Even in financial slumps, realty in this state tends to recover promptly.

4. Accessibility to High-Quality Projects

New york city is home to lots of credible developers with large, rewarding jobs. Partnering with skilled developers reduces the threat of defaults.

Just How Financial Obligation Investing Functions in New York City

1. Direct Borrowing

Financiers give loans directly to programmers or homeowner. This prevails for private jobs or smaller-scale advancements.

2. Realty Financial Obligation Funds

Signing up with a financial obligation fund permits financiers to merge sources and finance several projects, minimizing individual threat.

3. Crowdfunding Platforms

Systems focusing on property crowdfunding allow financiers to join debt investing with smaller capital outlays.

Advantages of Financial Debt Investing in New York

1. Regular Cash Flow

Capitalists get regular passion settlements, making it an attractive option for those seeking secure earnings.

2. Lower Volatility

Unlike equity investments, debt investing is much less influenced by market changes, supplying more foreseeable returns.

3. Guaranteed Investments

Property acts as security, lowering the danger of overall capital loss.

4. Easy Financial investment

Financial debt investing needs less energetic administration compared to possessing and preserving buildings.

Difficulties of Debt Buying New York Property

While financial obligation investing supplies various benefits, financiers should be aware of prospective challenges:

1. Rates Of Interest Risk

Rising and fall rate of interest can influence the returns on fixed-income financial investments.

2. Market Saturation

Certain areas in New york city might be oversaturated, resulting in increased competitors among financiers.

3. Lawful Intricacies

New york city's real estate market operates under rigorous policies. Financiers must guarantee conformity with state and government laws.

Key Areas for Financial Debt Investment in New York

1. New York City

Focus: High-end property growths, business property, and mixed-use tasks.

Benefits: High residential or commercial property values and worldwide demand.

2. Long Island

Focus: Rural housing developments and retail spaces.

Advantages: Growing populace and closeness to New York City.

3. Upstate New York

Focus: Multifamily properties, trainee real estate, and industrial rooms.

Advantages: Cost effective residential property costs and emerging markets.

Tips for Effective Financial Obligation Investing in New York City

Research the marketplace: Comprehend the demand, building worths, and development patterns in specific areas.

Assess Debtor Reliability: Ensure the debtor https://greenspringscapitalgroup.com/blog/ has a strong record and financial security.

Evaluate the Security: Verify the home's worth and possible resale potential customers.

Expand Your Profile: Spread investments across multiple projects and regions to lessen threat.

Work with Experts: Collaborate with legal and monetary consultants accustomed to New york city's real estate market.

Debt investing in real estate is a compelling strategy for generating steady income with minimized threat, especially in a durable market like New York. The state's diverse building landscape, high demand, and stable building worths make it an superb choice for financiers looking to increase their portfolios.

Whether you're brand-new to debt investing or an knowledgeable investor, New York supplies possibilities to attain regular returns and economic safety and security. Explore this rewarding market today and take advantage of one of the most trustworthy investment methods in real estate.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Christina Ricci Then & Now!

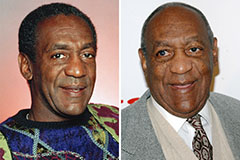

Christina Ricci Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!